The Consumer NOW Index has completed its fourth full wave of tracking showing a resurgence of consumer sentiment to levels similar to those we saw in wave 1. Fifty-seven percent of US respondents reported feeling either very positive or somewhat positive about their current daily life - up from 53 percent in wave 2 and just a few points shy of its peak at 60% in wave 1.

We see the incremental rise in sentiment as a sign that consumers are finding ways to cope and are becoming more accepting of their new routines. Unconscious feelings of strength and reason continue to dominate consumer motivations as spending habits across almost all categories have stabilized. Marketers and brand managers should continue to keep a pulse on consumers as they solidify their adjustments to a new normal while acknowledging the sacrifices that they’ve made.

Messages of solidarity and community will reinforce the rational aspects of a consumers’ underlying emotional motivations.

As sentiment climbs, consumers may be inclined to start treating themselves again. Brands should create targeted offers that support the notion of feeling good and self-care. This is especially important as boredom and cabin fever continue to be major challenges for consumers.

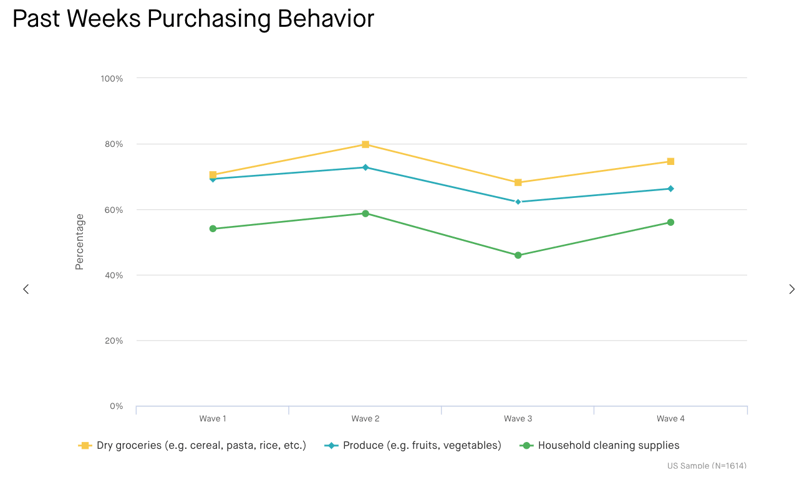

We’re beginning to see an interesting pattern in regards to consumer's spending habits. Specifically, a trend that consumers have adjusted to increased spending every other week. Between waves 1 and waves 2, we saw an uptick in a consumer’s spend on dry groceries, produce, and cleaning supplies. Spend on these products dropped in wave three and then resurged to higher levels again in wave 4. For example, 58 percent of consumers reported purchasing household cleaning supplies the week prior in wave 2. This number dropped to 46 percent in wave 3 before rising back up again to 56 percent in wave 4. While it may be too soon to tell, there is a similar patterns across nearly all categories which should be monitored by brands as they plan any pricing promotions or new campaigns.

Quick takes from the Consumer Now Index Wave 3 & 4

- Consumers are eating more snacks and sweets, streaming more content, and are video chatting with friends more now than what was reported in week 1 of tracking.

- There is a steady increase in the use of mobile payment services since tracking began.

- The majority of consumers (58 percent) took an average of 1 - 5 car rides in the previous week.

- 24 percent of female consumers purchased cosmetics in the previous week.

- 19 percent of men report a strong increase in their use of dating apps over the previous week compared to just 5 percent of women.

- 28 percent of Millennials report Amazon as their preferred retailer compared to 16 percent of Gex X’ers. Conversely, 24 percent of Gen X’ers report local grocery stores as their preferred retailer compared to just 9 percent of Millennials.

The full insights dashboard from quantilope’s Consumer NOW Index is available as a free resource here. We recommend opening it on a large screen.

Reach out below to get your own deep dive in the Consumer NOW data or to request a customized Index for your own brand.