We surveyed 489 physically active to understand how exercise habits have changed during COVD-19. Specifically, we asked consumers about their exercise frequency, types of workouts, drivers of working out, and fitness channels.

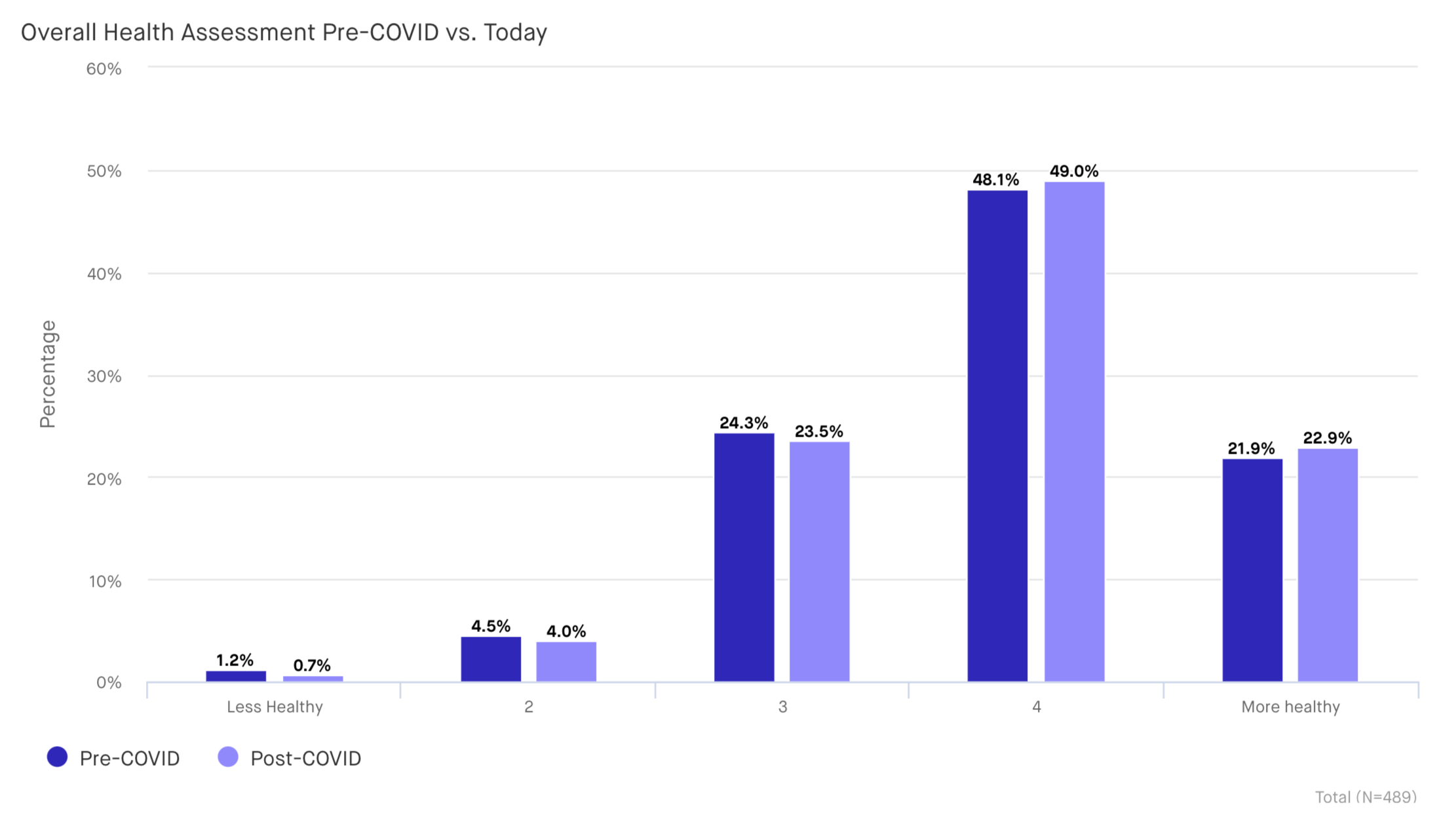

Although people haven’t had normal access to gyms, exercise frequency is on par with where it was pre-COVID-19. Self-assessment for overall fitness is currently above average, skewing higher for those who exercise more frequently.

Virtual workouts have played a big role in people’s at-home workout regimens. Nearly 40% of respondents reported taking part in virtual workouts, skewing even higher for Gen Z and Millennials at 51%. However, most interesting is that 65 percent of overall respondents are very satisfied with these offerings - indicating that virtual workouts may be here to stay even after gyms reopen nationally.

Virtual workouts have played a big role in people’s at-home workout regimens. Nearly 40% of respondents reported taking part in virtual workouts, skewing even higher for Gen Z and Millennials at 51%. However, most interesting is that 65 percent of overall respondents are very satisfied with these offerings - indicating that virtual workouts may be here to stay even after gyms reopen nationally.

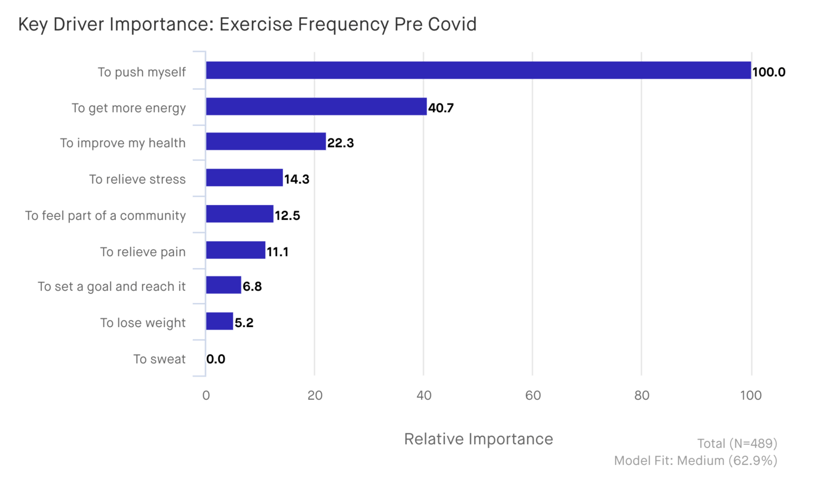

To understand what is keeping people motivated to work out we used a Key Driver Analysis (KDA) to evaluate the importance of various drivers for staying active. ‘Pushing oneself’ is the most important driver of working out and is 2x as important as ‘increasing energy levels’ - the second most important driver. ‘To sweat’ and to ‘improve sleep’ are the least important drivers.

Based on the KDA brands should market to their consumers by appealing to the desire to stay healthy, use marketing messages with an emphasis on pushing oneself and building a sense of community, and offer new workout methods (such as virtual classes).

The full dashboard including insights into how consumers expect workout behaviors to change post COVID-19, what are the most popular exercise types right now, and how brands can enhance their relationship with consumers during this time is available below.