In this blog, learn about quantilope's newest method: multi-implicit association testing (MIAT).

Previously known as MAT, MIAT now offers an even more enhanced user and participant experience for subconscious consumer data.

Table of Contents

- Why is implicit research important?

- How implicit research works

- Applications of MIAT

- MIAT with quantilope

Why is implicit research important?

In 2003, Harvard Business School professor Gerald Zaltman published his book “How Customers Think: Essential Insights into the Mind of the Market '' asserting as much as 95% of purchase decisions take place within the subconscious mind. ‘Latency’’, or speed of response time, is among the tools suggested by Zaltman to measure subconscious decision-making; the quicker a respondent makes an association, the stronger that subconscious association is with the element being tested. Twenty years after Zaltman’s published work, subconscious research in the form of implicit testing continues to be a competitive advantage for research teams.

Within today’s competitive landscape, it’s critical for brands to leverage implicit research in the development and evolution of their brand identity. By understanding true underlying consumer associations in an unbiased, subconscious manner and attaching your brand to them (i.e. healthy, innovative, trendy), you minimize the chance that your brand will get lost in a crowded marketplace while simultaneously future-proofing it against external elements like inflation.

Aside from brand identity, implicit research aids in virtually all areas of decision-making - from new product development to marketing communications, and everything in between. In each step of a business objective, understanding (and acting on) strong, unique consumer associations is what will separate successful brands from those that blend in as status quo.

For example, let’s say you operate in the snack space and your implicit research results show that your brand is the only one associated with ‘organic’. Because ‘organic shoppers’ is a key segment of your target audience, you can align marketing messaging or future product development to that association to cater to existing organic shoppers, and to capture new ones. Additionally, say another segment of your target audience is ‘convenience consumers’. Knowing which other brands in your category are strongly associated with ‘accessible’, ‘on-the-go’, or ‘pre-portioned’ will help you further differentiate your own offer to be even more convenient than that competitor.

Back to table of contents

How implicit research works

Knowing why implicit research testing is so important to stand out for your own unique associations and among competitors, how do you go about doing it? Brand managers need to execute rigorously and efficiently when dealing in a dynamic competitive environment. As such, a mobile-compatible implicit testing tool like quantilope’s MIAT (Multiple Implicit Association Test) lets brands reach consumers quickly and review their feedback in real-time.

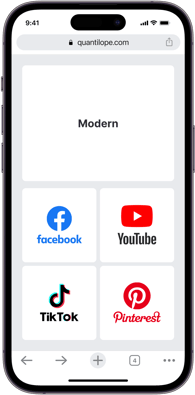

quantilope’s MIAT allows users to evaluate multiple brands at the same time, creating a more realistic competitive environment (like a store shelf) without increasing the length of the interview. This is achieved by displaying four brands instead of one and asking respondents to select the brand(s) they feel ‘fits’ most to the displayed association - as shown below:

Given the mobile-ready nature, respondents can take a MIAT survey from the comfort of their own home, while commuting on the train, or even while standing in line at the store, giving brands the most authentic read of how consumers actually think about brands in their everyday lives.

Back to table of contents

Applications of MIAT

The cool part about a MIAT is that you can test associations in nearly any category. So beyond the traditional competitive environment of typical goods like snacks or household items, you have categories that are very consolidated yet intensely competitive - such as internet providers, or that are incredibly niche - such as premium or luxury goods.

For example, is the service from an internet provider accessible and positioned properly to remove any gaps for close rivals? Or, are there areas within their customer service that are falling, leaving space for close competitors to act on? Among premium or luxury goods, is the brand maintaining associations of being a specialized, high-value brand? Or, have mid-market competitors begun to sway consumers through an assortment of similarly appealing features at a lower price point? These are all things to test implicitly, as they’re often elements of a brand that consumers might find hard to put into words.

Regardless of your brand type or the space you operate in, brand associations play an increasingly impactful role in maintaining loyalty and positioning your brand for new customers. If you were to find out a new entrant or existing competitor was acquiring share in your category, are you equipped with the type of tools needed to measure the associations that drive consumer conversion?

Back to table of contents

MIAT with quantilope

quantilope’s mobile-compatible implicit SIAT and MIAT methods help brands in any category, with teams of any research skill level to measure consumer associations that guide strategic decision-making. quantilope’s fully proprietary implicit methods take the tedious work out of traditional implicit research, with an automated setup and intuitive participant view.

To start implicitly testing your category, brand, or product associations, get in touch below!