Pricing research is any form of research that provides a brand with information telling them what consumers are willing and able to spend on their products and/or services.

Table of Contents

- What is pricing research?

- Benefits and ROI of pricing research studies

- Pricing research methods

- Choice-based Conjoint analysis

- Price Sensitivity Meter/Van Westendorp

- How to run automated pricing research with quantilope

- Pricing research tools with quantilope

- Pricing research examples

- Are you ready to enhance your pricing strategy?

What is pricing research?

Pricing research is the process of gathering and analyzing information to understand how customers perceive and respond to different price points for a product or service. It's a critical component of effective pricing strategies, helping businesses determine the optimal price that maximizes profitability while remaining attractive to customers.

Through pricing surveys, focus groups, experiments, and other forms of research, brands can delve into the minds of consumers to uncover how much they're willing to pay, what factors influence their purchasing decisions, and how price compares to the perceived value of an overall offering.

For example, say a brand is thinking about moving its revenue intake to a subscription-based model. What are consumers spending on similar subscription-based products/services? Do consumers prefer an annual subscription over a monthly subscription? What is the most a brand could charge without losing their customer base during this shift in their revenue stream? These are the types of questions a brand should be leveraging pricing research for before making impactful decisions that could make or break their business.

Below are some specific insights that stem from pricing research:

- Price sensitivity: How much does a change in price affect demand for a product?

- Perceived value: How does price align with customers' perceived benefits of the product or service?

- Competitive landscape: How do your prices compare to those of your competitors?

- Optimal price points: What price points maximize profitability while maintaining market share?

By conducting thorough pricing research, businesses can make informed decisions to avoid leaving money and valuable resources on the table.

Back to Table of Contents

Benefits and ROI of pricing research studies

Pricing studies are an important aspect of a business' research approach, because as societal norms and behaviors shift over time, so do pricing expectations based on changing market conditions. When you think of your favorite brands, it’s likely true that those brands have grown, changed, and adapted over the years to stay relevant with changing times and changing demands.

Take for example your preferred toothpaste brand or favorite body wash, and how their packaging or branding has changed since you first bought it many years ago. Has the price changed too? You might continue to buy that brand because you’ve come to know and trust it, but that doesn’t mean you won’t be swayed to try something new if you find a better-priced offer. To maintain a loyal customer base, brands must keep up with the competition by growing, shifting, and adapting aspects of their products - and pricing strategy is no exception

Below are a few ways pricing research can give your business a competitive edge:

- Optimized pricing strategies: Discover the sweet spot where price aligns with perceived value, maximizing both sales volume and profit margins.

- Enhanced competitiveness: Gain a clear understanding of the competitive landscape and identify unique opportunities to differentiate your pricing strategy.

- Improved customer satisfaction: Ensure your pricing resonates with customer expectations, fostering loyalty and minimizing lost sales due to price.

- Reduced risk: Lower your price-related risks by gathering data-driven insights and testing different pricing models before launching a new product or service (or before changing pricing on existing offers).

- Increased revenue and profitability: Ultimately, effective pricing research leads to better pricing decisions, driving revenue growth for your business.

The ROI of pricing research

While conducting pricing research requires an upfront investment (as does many forms of research), the potential return far outweighs the costs. Even small adjustments to your pricing strategy, informed by research, can significantly impact your profitability.

For example, imagine a software company that invests in pricing research and discovers their customers are willing to pay 20% more for a premium package. This insight allows them to adjust their pricing accordingly, resulting in a substantial increase in revenue - quickly making up for their initial research investment.

Pricing research is a smart investment that empowers businesses to make informed decisions, optimize their pricing strategies, and drive sustainable growth. By understanding the value customers place on your offerings, you can unlock new levels of profitability and strengthen your competitive advantage.

Back to Table of Contents

Pricing research methods

There are many types of market research pricing methodologies available to insights leaders. Each methodology offers a unique viewpoint into pricing strategy and highlights various pricing insights - from optimal price points, to ideal price range, and price sensitivity levels. Below are a few commonly-used pricing methods/approaches in market research:

- Choice-based Conjoint analysis

- Price Sensitivity Meter/ Van Westendorp

- Gabor-Granger method

- Monadic price testing

- Brand Price Trade-off (BPTO)

- Cost-plus pricing

- Value-based pricing

- Competitive pricing

Amidst the plethora of pricing research options out there, quantilope has automated two of the most commonly leveraged: Choice-based Conjoint analysis and Price Sensitivity Meter (PSM)/Van Westendorp. In the sections below, we explain what each of these pricing methods are in more detail.

Back to Table of Contents

Choice-based Conjoint analysis

Using Choice-based Conjoint analysis for pricing research is considered one of the more sophisticated pricing research methods. This method captures consumer preferences (price included) by presenting respondents with a set of products with different individual attributes, and asking them to select one product from that choice set. It can be used to gain a deeper understanding of consumers, allowing brands to create preference-based audience segments.Unlike other quantitative pricing methods, a Conjoint analysis considers multiple aspects of a product and places them in a competitive context (two reasons why this method is considered more sophisticated than other approaches). This creates a scenario that most closely simulates a real-life shopper experience by comparing different products when it comes to a number of product attributes like packaging type, ingredients, and of course, price.

Back to Table of Contents

Price Sensitivity Meter/Van Westendorp

Price Sensitivity Meter/Van Westendorp is a pricing research method created by Dutch economist Peter Van Westendorp that's used to investigate varying price perceptions and price limits consumers have.

This particular pricing method asks respondents a series of four pricing questions:

- At what price would you consider the product to be so expensive that you would not consider buying it?

- At what price would you consider the product to be priced so low that you would feel the quality couldn’t be very good?

- At what price would you consider the product starting to get expensive, so that it is not out of the question, but you would have to give some thought to buying it?

- At what price would you consider the product to be a bargain—a great buy for the money?

Given the simplicity of a four-question approach, researchers can use this pricing method when they need to quickly and efficiently gauge a range of acceptable prices for a product or service. It's particularly useful for new products or services where there's no existing market data to rely on, as it helps identify potential price thresholds and understand customer perceptions of value.

Back to Table of Contents

How to run automated pricing research with quantilope

quantilope’s approach to these two above-mentioned pricing methods allows brands to obtain pricing insights quicker than with other vendors, with more flexibility, and with the support of a team of certified research experts.

Choice-based Conjoint at quantilope:

Choice-based Conjoint studies include many different analytical outputs that can help drive pricing decisions. With quantilope’s end-to-end, automated Consumer Intellifence Platform, all these analytical charts are available in real-time, in one spot, and with the ability to customize base groups, chart colors, and more.

Because Choice-based Conjoint is considered one of the more sophisticated ones in pricing research, quantilope users benefit from ongoing access to a dedicated team of certified research consultants, along with guidance from the platform's AI co-pilot, quinn. These resources are readily available to help craft effective pricing questions and ensure the analysis is insightful and impactful for your stakeholder meetings.

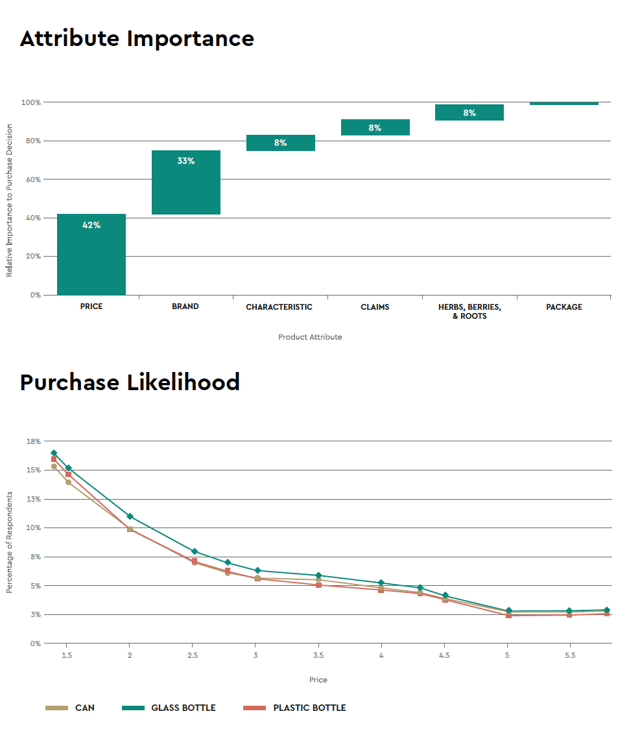

Below are two examples of Choice-based Conjoint outputs on quantilope’s platform, the first for incremental Attribute Importance and the second for Purchase Likelihood:

Price Sensitivity Meter/Van Westendorp at quantilope:

As mentioned, this method asks respondents a series of four specific pricing questions. From those four questions, quantilope automatically generates a chart with the following price points:

- Optimal Price Point: The price at the intersection of ‘too cheap’ and ‘too expensive’ (shown below with a crown icon)

- Indifference Price Point: The price at the intersection of ‘cheap’ and ‘expensive’ (shown below with an upward-facing arrow)

- Price Range: The shaded green section below between the lower/upper price limits (shown with a downward-facing arrow and circle icon, respectively).

%20Chart%20Example.png?width=629&name=Price%20Sensitivity%20Meter%20(PSM)%20Chart%20Example.png)

By leveraging quantilope’s platform for this pricing method, users generate an intricate output (like the one above) from just a simple drag + drop of the method into their survey from the platform's pre-programmed method library (the largest of any automated research platform!). Like all methods, quantilope’s Price Sensitivity Meter is also fully customizable, so users are able to adjust the specific price points within the analyze function and immediately see how those price fluctuations shift the brand’s overall share of preference.

Back to Table of Contents

Pricing research tools with quantilope

While traditional pricing research often involves manual surveys and tedious data analysis, quantilope streamlines the pricing research process with several automated features:

- Automated, advanced methods: As mentioned above, quantilope users have the option to choose from several automated pricing methods, simply by dragging and dropping their chosen method into their survey and customizing pricing details as needed. Team members can work within quantilope's platform simultaneously, with any survey or charting edits showing real-time changes so there's never any version control issues.

- AI co-pilot assistance: quantilope's integrated AI co-pilot, quinn, is available to platform users at any time throughout their pricing research project. Whether it's to get ideas on survey question phrasing, generate insightful chart headlines, or summarize a dashboard for stakeholders, quinn provides instant guidance and support.

- Advanced analytics dashboards: Visualize and interpret your pricing research data with quantilope's interactive dashboards that provide clear and actionable insights. By hovering over a chart with your mouse, you can instantly see which data points are statistically significant - no calculations needed. Dashboards are shareable with a single URL link and update in real time so that any changes you and your team make will be reflected for any viewer with the shared link.

quantilope's automated approach to research makes it quicker and easier for teams to make data-supported decisions around their pricing structure. Next, we'll look at a few examples of pricing research for further context into how these pricing methods and tools work.

Back to Table of Contents

Pricing research examples

To illustrate the power of pricing research, let's explore a few realistic examples for various industries interested in exploring their pricing models:

- The streaming service: A streaming service provider wants to understand how different pricing tiers and features impact subscriber acquisition and retention. Through Choice-based Conjoint analysis, they discover that customers valued a wider selection of content more than they value a slightly lower price. This insight leads them to adjust their pricing strategy, offering a premium tier with a broader content library at a slightly higher price point, resulting in increased revenue and customer satisfaction.

- The consumer electronics company: A consumer electronics company is launching a new smartphone and needs to determine the optimal price point to bring it to market. They utilize a Van Westendorp Price Sensitivity Meter (PSM) to gauge customer perceptions of value and identify acceptable price ranges. Their research reveals that customers are willing to pay a premium for advanced camera features and longer battery life. Armed with this knowledge, the company confidently prices their new smartphone at the higher end of the acceptable range, achieving strong sales and profitability.

- The SaaS startup: A young Software as a service (SaaS) startup is developing a new project management tool with several innovative features. They're unsure how to price this new software, particularly considering the competitive landscape. They conduct a Choice-based Conjoint analysis to understand the relative importance of features like task automation, team collaboration, and integrations, as compared to price. The research reveals that customers are willing to pay a premium for advanced automation features, but were less sensitive to the price of basic collaboration tools. This allowed the startup to create a tiered pricing structure with a higher-priced plan that emphasized automation capabilities, successfully attracting customers who value those features, thus maximizing their overall revenue.

These examples demonstrate how pricing research can provide valuable insights that inform strategic decisions, optimize pricing, and drive business success. By understanding customer perceptions of value and price sensitivity, companies can confidently position their products and services in even the most competitive markets, maximizing both revenue and customer satisfaction.

Back to Table of Contents

Are you ready to enhance your pricing strategy?

Brands who are proactive in their use of market research budget for pricing studies will be the brands that stay the most relevant and competitive as the cost of interim goods continues to rise. Pricing your end product too high will risk the loss of valued customers. Pricing an end product too low will lead to troubling margins and limited growth.

To learn more about how you can leverage various pricing strategies for your brand, download The Ultimate Guide to Automated Pricing Research Whitepaper below which includes two short demo videos on each of quantilope’s automated pricing methods mentioned in this article.